Super tax deduction

There's never been a better time to upgrade

New UK tax rules mean you can save thousands of pounds on the latest commercial kitchen appliances

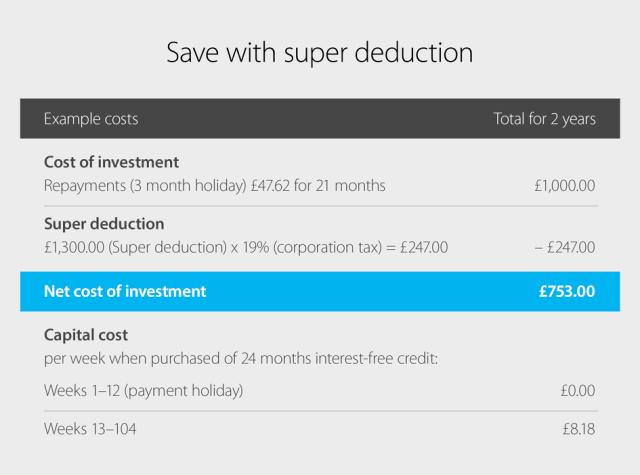

The super-deduction tax break means you get 130% first-year relief on new fridges, freezers, and cabinets as well as whole range of other essential equipment. It’s an ideal opportunity to upgrade and invest in the future of your outlet. The super-deduction allows companies to cut their tax bill by up to 25p for every £1 they invest on new plant and machinery.

Here’s how it works

Let’s say your business spends £10,000 on kitchen equipment. When you calculate your taxable profits your corporate tax deduction will be £13,000 (i.e. 130% of your initial investment). Deducting £13,000 from your taxable profits will save your business up to 19% of that – 19% of £13,000 is £2,470. And that’s how much corporation tax you save if you qualify for super-deduction.

Interest-free credit or leasing

options are also available

At Foster Refrigerator we’ve added our own mouth-watering incentive. If you buy from us, you can also take advantage of our award-winning interest-free credit scheme.

Our hugely successful 12-month interest-free credit offer has been doubled, so you’ll now be able to pay for your equipment over 12, 18 or 24 months, all while its working for you. And what’s more, you’ll own the product after the final payment. Subject to credit checks we don’t even take a deposit, and there’s even the option to include the installation and extended warranty cost within the payments.

FAQs

The UK goverment have produced this handy guide.